Ask anyone working in a smaller accounting firm whether they feel they have enough resources to do their job correctly and the answer you're likely to get is a resounding "no". But that response is never stronger than when important new tax laws are announced.

Without the benefit of a larger team backing them up, small firms are left to scramble when new legislation hits. In order to communicate the impact to clients and their own professionals, they're forced to spend hours going through long, cumbersome, detailed documents to figure out what’s really important and what it all means for clients. It’s an imperfect science at best—and one that can consume a ton of valuable time, often from some of the firm’s most valuable professionals. They deserve better than hours spent on complicated, heavily manual research software and Google searches.

Where existing tools and approaches fall short

Traditional tax research tools are powerful, but they’re also tough to navigate, which makes it hard to get the right answers quickly. At many small firms, only one person may have a user license or know how to use them properly, which means that they’re on the hook for researching and interpreting the rules for everyone else. This results in a bottleneck at exactly the moment when firms need to meet tight deadlines and deliver precise answers and advice as quickly as possible. In a perfect world, these types of tools and insights would be accessible to every professional who needs them, not just one research warrior.

AI opens the door to a smarter approach

As managing partner at Maryland-based GWCPA, a firm with fewer than 20 employees, Samantha Bowling was frustrated with the inefficiency of the firm’s approach to tax research. The entire firm depended on a handful of team members to make sense of every new tax regulation. These individuals would have to drop everything to focus on research rather than spend valuable time on billable client work. “Our research relied on a mix of Google and standard tax research tools,” said Bowling. “The research tools were hard to navigate, while Google was a pretty lightweight approach that didn’t always inspire real confidence in the answers.” So, when advanced AI tools started hitting the market, Bowling sensed a new opportunity.

GWCPA embraced an AI tool for a better tax research solution

With several tax-focused AI solutions on the market, GWCPA had options to

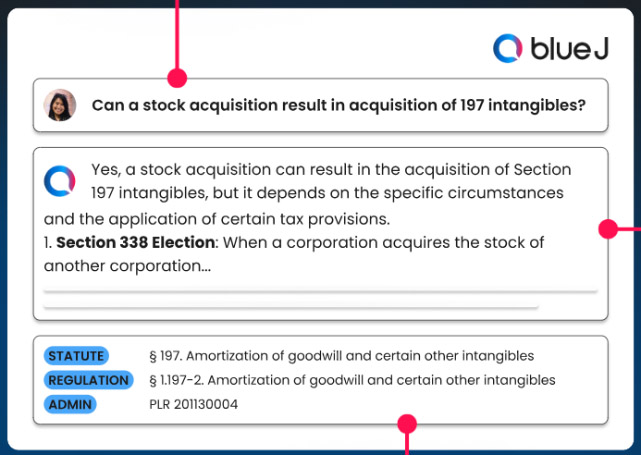

choose from. The firm ended up selecting Blue J, an intuitive tool that uses generative AI to create clear,

easy-to-understand answers in responses to user queries, drawing directly from massive volumes of tax legislation

documents.

With several tax-focused AI solutions on the market, GWCPA had options to

choose from. The firm ended up selecting Blue J, an intuitive tool that uses generative AI to create clear,

easy-to-understand answers in responses to user queries, drawing directly from massive volumes of tax legislation

documents.

“AI has transformed how we conduct tax research,” said Bowling. “Instead of one or two people handling research, now our whole team has direct, easy access to the same insights on demand. They’re doing their own research, and they’re gaining a lot of valuable knowledge along the way.”

Blue J’s AI capabilities have given GWCPA a number of other important advantages on the tax research front, including:

Faster, more accurate research

Blue J’s AI platform quickly scans authoritative sources and provides accurate, verifiable answers to challenging

tax questions in seconds. As a result, GWCPA shifted from time-consuming searches to near-instant answers.

More confidence in answers

When Blue J generates answers, it provides direct links to source documents to ensure compliance and verification.

These sources are constantly updated, managed and curated through a reliable database of trusted tax content from

government sources and Tax Notes’ news and commentary. This is an important distinction since many other AI tools

can’t be depended on to provide authoritative, accurate, well-sourced answers. “Blue J even caught an updated tax

rule that I probably would have missed otherwise,” says Bowling. With better insights (and less time required to

generate them), firms have a powerful opportunity to focus more on higher-value, advisory-level tax services.

Improved client communication

AI-generated client-emails translate complex tax topics into plain language. GWCPA users simply review the email

drafts, modify them as necessary, and hit “send.” Bowling commented, “I gave Blue J a particularly dense tax memo

and asked it to translate the memo into an easy-to-understand client email. I was amazed at how accurate and

professional it was—it saved me so much time and was well received by our clients.”

Low barriers to adoption

Many professionals are naturally hesitant to use AI tools. Will it replace us? Can I trust AI-generated outputs?

Won’t it be hard to learn? These are all common and understandable concerns. For Bowling, the key is

remembering that AI is a powerful assistant, not a replacement. Human insight and oversight are still required for

successful AI adoption. And she noted that her team found Blue J easy to use, so the staff quickly embraced it. And

AI-powered tax research can be more cost-effective than traditional solutions.

AI is the future of tax research at small firms

Tax research plays a huge role in any firm’s ability to provide high-quality, advisory-level service to its clients. Until now, large firms have held the advantage in tax research, because they have the resources and staffing required to sift through piles of new tax legislation. AI changes all that. The same capabilities that allow professionals across industries to make quick work of massive volumes of data are ready to help tax professionals get the research insights they need in a matter of seconds, using simple, focused queries. Just like GWCPA, your firm can be more efficient, accurate, and confident in its tax research than ever.

Learn more about Blue J, and hear more about Samantha Bowling’s experience in this on-demand webinar.