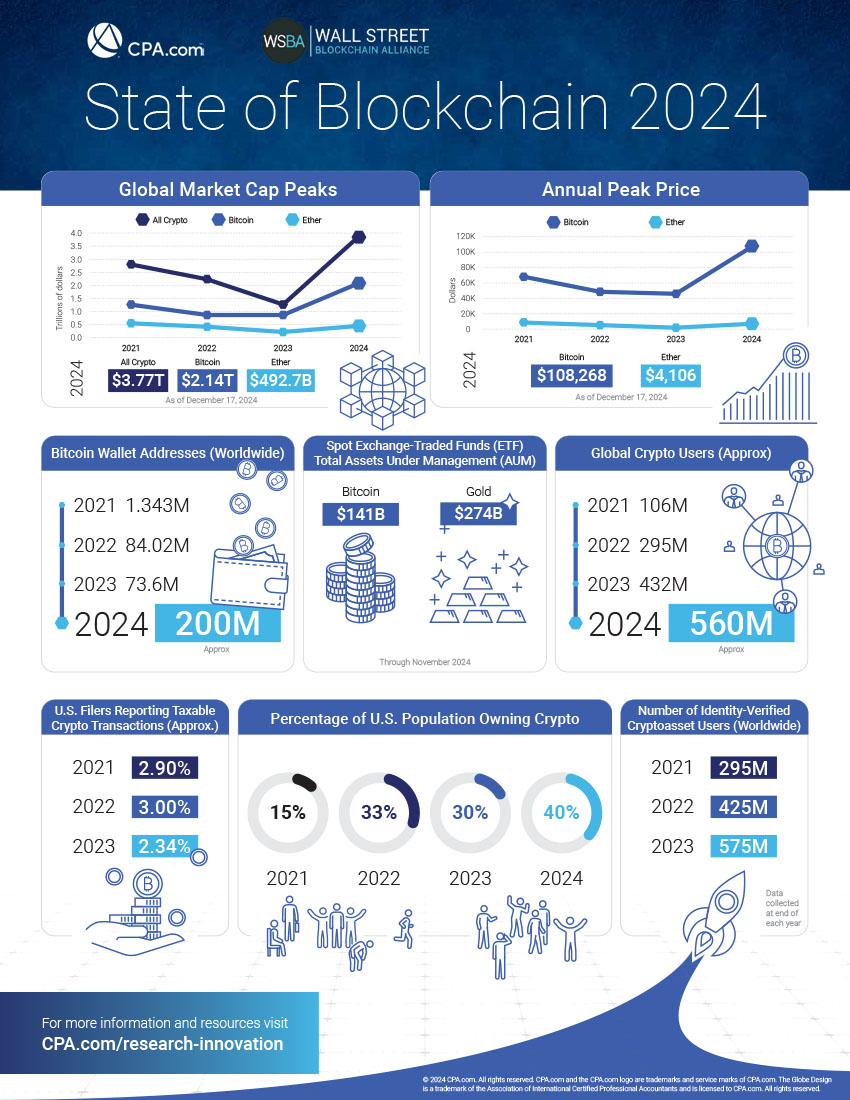

Blockchain technology has turned a corner, emerging as a transformative force in modern finance, influencing how firms operate, and redefining the services they offer. With a global crypto market now valued at over $3.7 trillion—tripling from $1.09 trillion just last year—and over 560 million crypto users worldwide, digital assets are reshaping the financial ecosystem. This market growth was further compounded by the 2024 U.S. presidential election which contributed to around $1 trillion in growth in a matter of weeks with the anticipation of a more accommodating administration that has already nominated crypto-friendly agency heads. Just before election day, these trends were front and center at the CPA.com and AICPA Blockchain Symposium hosted in collaboration with the Wall Street Blockchain Alliance, where industry leaders gathered to discuss blockchain’s current landscape and implications for accounting and finance professionals.

As digital assets gain mainstream traction, firms have a unique opportunity to lead the way, advising clients on everything from tokenized investments to crypto tax compliance. The following trends explored at the symposium highlight the innovations and regulatory shifts driving blockchain’s growth—and why now is the time to prepare your team to tackle the challenges ahead.

-

Growing regulatory focus on digital asset reporting

Regulatory oversight is rapidly evolving to keep up with the mainstream growth of digital assets. Federal and state agencies are implementing new guidelines, with a strong focus on crypto tax reporting, stablecoin transparency and proof of reserves. This shift underscores the importance of proactive digital asset compliance, positioning accountants as essential advisors in this evolving landscape.

CPAs are uniquely positioned to turn these regulatory shifts into strategic advantages for their clients. By staying current on the latest IRS guidance for digital assets, leveraging AICPA resources like the updated Digital Assets practice aid or earning the Blockchain and digital assets fundamentals certificate, and navigating SEC oversight, you can help clients avoid penalties and seize opportunities for growth.

-

Tokenization of traditional and alternative assets

Tokenization is transforming traditional investment by converting assets like real estate, private equity and fine art into digital tokens on a blockchain. With tokenized funds becoming a major focus for firms like BlackRock and Lazard, the market is rapidly evolving. This process allows investors to buy fractions of high-value assets, increasing accessibility and liquidity and introducing new complexities that require a clear understanding of financial and regulatory implications.

With oversight still evolving, firms must stay informed on how tax obligations, transaction reporting and compliance requirements differ for tokenized versus traditional securities. Building expertise in tokenized assets enhances your advisory services, enabling you to help clients understand the complexities of these new investments and position your firm as a leader in digital finance. To stay informed on evolving regulations and market trends, resources like the Tax Section Odyssey podcast offer timely updates and insights.

-

Expansion of crypto ETFs and institutional engagement

With over $111.7 billion in inflows for spot Bitcoin exchange-traded funds (ETFs) as of Dec. 12, major institutions like BNY Mellon and Fidelity are driving the adoption of crypto through regulated financial products. These developments provide a clear pathway for investors to gain exposure to cryptocurrencies like Bitcoin and Ethereum, signaling a new phase of mainstream acceptance. As more clients—from individual investors to large corporations—build digital asset portfolios, CPAs will need to expand their expertise in this area.

Consider how these ETFs align with your clients’ broader investment strategies: Are they diversifying risk appropriately? Do these investments fit into their long-term financial goals? Additionally, familiarize yourself with ETF-specific reporting requirements, valuation challenges and potential tax obligations to ensure clients meet compliance standards.

-

Stablecoin assurance and reporting standards

With stablecoins gaining traction, they bring both challenges and opportunities in audit and assurance, especially for fiat-backed stablecoins that require rigorous, transparent reserve reporting. This is a prime area where CPAs can provide independent assurance to meet the growing need for transparency and compliance in the stablecoin market.

For instance, the AICPA’s stablecoin criteria, set to publish in January, will offer a framework to evaluate and disclose critical details, such as the number of outstanding tokens and the assets available to redeem them. By leveraging these tools, your team can help stablecoin issuers meet regulatory requirements and demonstrate credibility to investors and stakeholders. Providing regular attestation services, such as monthly reserve validations, not only builds trust but also positions your firm as a leader in this emerging area.

-

The shift from "crypto winter" to market resilience

The crypto market has not only rebounded from previous downturns but has now attained all-time highs. Understanding this dynamic is essential for supporting clients through volatility and growth in digital assets. Increased regulatory oversight also adds a layer of security, helping to establish crypto as a viable asset class.

By staying on top of these developments, you can offer clients insights into how market resilience affects investment opportunities, tax obligations and reporting requirements, helping them make well-informed financial decisions.

About the authors

As CPA.com’s vice president of Strategy & Innovation, Kacee Johnson manages the technology ecosystem to identify emerging trends that are driving change in the profession and works collaboratively with the vendor and thought-leader community to develop thought leadership content and events for C-suite leaders.

Ron Quaranta is the current Chairman and CEO of the Wall Street Blockchain Alliance, the world’s leading non-profit trade association promoting the comprehensive adoption of blockchain technology and crypto assets across global markets. Ron has edited and contributed to multiple books on blockchain and digital assets and is a frequent guest on major media outlets.